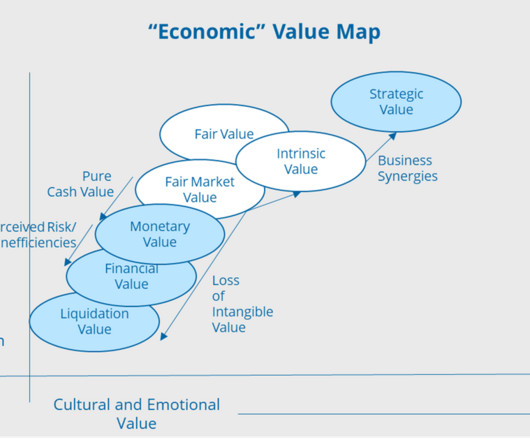

Transcending Value – Liquidation, Monetary, Financial, and Strategic Value

Value Scope

JUNE 2, 2021

Environmental, social, and governance (ESG) value is relatively new, and gaining acceptance in corporate America. Valuation necessarily requires an understanding and deep insight into accounting, economics, and finance. Now, statistical analysis, behavioral finance, and cultural economics are playing a more frequent role in valuation.

Let's personalize your content