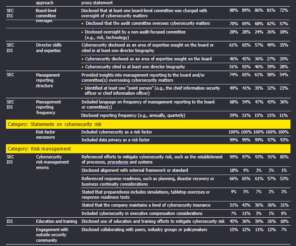

How cyber governance and disclosures are closing the gaps in 2022

Harvard Corporate Governance

OCTOBER 2, 2022

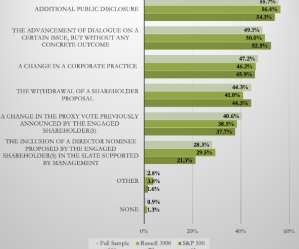

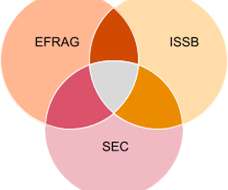

Posted by Chuck Seets and Pat Niemann, EY, on Sunday, October 2, 2022 Editor's Note: Chuck Seets is Americas Assurance Cybersecurity Leader and Pat Niemann is Americas Audit Committee Forum Leader at EY. This post is based on their EY memorandum. Cybersecurity is reaching an inflection point. Risks are growing and broader regulations are looming. Some companies are keeping pace, but others are lagging, both in disclosures and warding off threats.

Let's personalize your content