Joann, 80-Year-Old Crafts and Fabrics Retailer, Will Close All Stores

NYT M&A

FEBRUARY 24, 2025

The announcement that the chain would close all 800 of its stores in 49 states comes after a period of financial turmoil.

NYT M&A

FEBRUARY 24, 2025

The announcement that the chain would close all 800 of its stores in 49 states comes after a period of financial turmoil.

Mckinsey and Company

FEBRUARY 24, 2025

Generative AI adoption is taking longer than expected. But AI innovation is rapidly accelerating, and businesses must seize the opportunity to stay competitive.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Law 360 M&A

FEBRUARY 24, 2025

The CEO of 23andMe has teamed up with private equity firm New Mountain Capital on an offer to purchase and take the genetic testing company private at an equity value of approximately $74.7 million, according to a filing with the U.S. Securities and Exchange Commission.

Mckinsey and Company

FEBRUARY 24, 2025

A tailored, thoughtful combination of cutting-edge technologies, stronger contracting skills, and deep supply chain capabilities can get a new factory up and runningwithout costly delays.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Financial Times M&A

FEBRUARY 24, 2025

Middle Eastern company has made a fresh approach after walking away from offer last year

Butcher Joseph & Co.

FEBRUARY 24, 2025

ButcherJoseph served as financial advisor to ERW Site Solutions on a sale to its employees. The post ButcherJoseph Advises ERW Site Solutions on a Sale to Its Employees appeared first on ButcherJoseph & Co.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Trout CPA

FEBRUARY 24, 2025

We are delighted to celebrate an important milestone in Jacob Kaplans career as he officially earns his Certified Public Accountant (CPA) designation!

Financial Times M&A

FEBRUARY 24, 2025

Private equity investors partner says the regions market isnt as crowded as in the US

Farrel Fritz

FEBRUARY 24, 2025

I am increasingly encountering businesses that straddle across several different entities, especially LLCs. The popularity of LLCs, their relatively low cost of organization, and business owners’ apparent desire to compartmentalize their businesses means that, these days, there are good odds that even the simplest businesses are actually a combination of two or more affiliated entities with the same management and ownership.

Financial Times M&A

FEBRUARY 24, 2025

Gulf state aims to secure critical food supply chains and reduce reliance on imports

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Peak Business Valuation

FEBRUARY 24, 2025

The interior design industry helps clients create unique, functional, and aesthetically pleasing environments. With the growing demand for interior design services, we can expect the industry to generate billions in 2025. As such, running an interior design business can be very rewarding. If you want to buy , grow , or sell an interior design business , consider obtaining a business valuation.

Exit Strategy

FEBRUARY 24, 2025

Exit Strategies Group recently served as financial advisor to the owners of industrial automation solutions provider Clayton Controls, on their sale to KKR portfolio company Flow Control Group. Effective February 3, 2025, this acquisition adds market coverage, talent and technical services to FCGs growing industrial automation group. Transaction terms will not be disclosed.

Law 360 M&A

FEBRUARY 24, 2025

The president of Argentina has disclosed plans to probe whether the $1.25 billion sale by Spanish telecommunications giant Telefnicaof its business in the South American country to Telecom Argentina will create a monopoly.

Financial Analyst Insider

FEBRUARY 24, 2025

When someone passes away, their estate often undergoes a legal process called probate. This can involve organizing assets, settling debts, and ultimately distributing what remains The post Navigating Probate Funding: Bridging Financial Gaps During Estate Settlements appeared first on Financial Analyst Insider.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Law 360 M&A

FEBRUARY 24, 2025

U.S. Steel and Nippon Steel have pressed a Pennsylvania federal court to leave intact their suit accusing Cleveland-Cliffs and United Steelworkers union leadership of illegally conspiring to prevent their planned $14.9 billion merger, arguing that they're trying to block an "unlawful agreement," not shut down political speech.

Financial Times M&A

FEBRUARY 24, 2025

Sale to firm partially owned by Grupo Clarn triggers antitrust scrutiny from President Javier Milei

Law 360 M&A

FEBRUARY 24, 2025

Canadian Pacific Kansas City is defending the government's approval of the $31 billion merger that created the railroad, telling the D.C. Circuit to reject a challenge to that decision because there was no flaw in the Surface Transportation Board's findings.

Financial Times M&A

FEBRUARY 24, 2025

Private capital group is seeking to intensify competition with rivals including Blackstone

Law 360 M&A

FEBRUARY 24, 2025

A public opposition campaign complete with website and street signs has surfaced to oppose corporation and bar-backed legislation that would overhaul Delaware stockholder litigation rights and fee awards, intensifying an already unprecedented political fight that broke out last year over corporate governance concessions.

Norman Marks

FEBRUARY 24, 2025

I have been following many threads on this topic. I do not profess to be an expert on AI, and I am a retired rather than an active head of internal audit (CAE).

Law 360 M&A

FEBRUARY 24, 2025

Private equity shop CVC on Monday announced that it has agreed to sell its majority stake in Indian oncology hospital chain Healthcare Global Enterprises to Simpson Thacher & Bartlett LLP-advised KKR for $400 million.

John Jenkins

FEBRUARY 24, 2025

Here’s a scenario that’s guaranteed to put a knot in any M&A lawyer’s stomach – on the eve of a target’s stockholders meeting to vote on a proposed stock deal, the buyer’s board announces that it’s conducting an internal investigation in response to a whistleblower complaint and that one of the buyer’s directors, who was […]

Law 360 M&A

FEBRUARY 24, 2025

A Texas federal court's recent denial of a Federal Trade Commision order to stop a giant mattress merger because of lack of evidence on market segments shows that such definitions are only a viable path for regulating vertical mergers if antitrust agencies provide adequate documentation, says David Kully at Holland & Knight.

Financial Times M&A

FEBRUARY 24, 2025

Amsterdam-listed tech investor doubles down on food delivery in Europe

Law 360 M&A

FEBRUARY 24, 2025

The buyer of eight Steward Health Care hospitals said the bankrupt company is putting patients' lives at risk by failing to provide funds and services it promised, urging a Texas federal judge to compel Steward to comply with contracts it signed as part of its hospital sales.

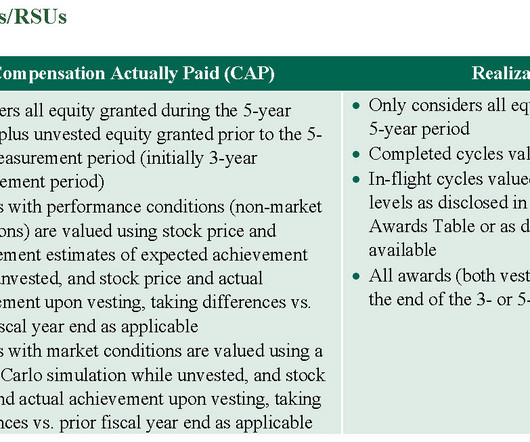

Harvard Corporate Governance

FEBRUARY 24, 2025

Posted by Ira Kay and Max Jaffe, Pay Governance LLC, on Monday, February 24, 2025 Editor's Note: Ira Kay is a Managing Partner and Mike Kesner is a Partner at Pay Governance LLC. This post is based on their Pay Governance memorandum. Introduction Realizable pay (“RP) is composed of cash compensation paid (e.g., salary, actual bonus awards and payouts of cash-based long-term incentives) and the value of equity awards using the stock price at the end of the assessment period.

Law 360 M&A

FEBRUARY 24, 2025

Lawyers everywhere are feeling overwhelmed amid mass government layoffs, increasing political instability and a justice system stretched to its limits but a design-thinking framework can help attorneys navigate this uncertainty and find meaning in their work, say law professors at the University of Michigan.

Harvard Corporate Governance

FEBRUARY 24, 2025

Posted by Sarath Sanga (Yale Law School) and Gabriel Rauterberg (Michigan Law School), on Monday, February 24, 2025 Editor's Note: Sarath Sanga is a Professor of Law and Co-Director of the Center for the Study of Corporate Law at Yale Law School, and Gabriel Rauterberg is a Professor of Law at the University of Michigan Law School. This post is based on their recent article forthcoming in Yale Journal on Regulation , andis part of the Delaware law series ; links to other posts in the series are

Law 360 M&A

FEBRUARY 24, 2025

Blackstone has agreed to acquire Dallas-based Safe Harbor Marinas, the largest marina and superyacht servicing business in the U.S., from Sun Communities Inc. for $5.65 billion, the companies said Monday.

Benzinga

FEBRUARY 24, 2025

Bridge Investment Group Holdings Inc. (NYSE: BRDG ) shares are trading higher on Monday after the company entered a deal to be acquired by Apollo Global Management, Inc. (NYSE: APO ) in an all-stock transaction valued at around $1.5 billion. As per the terms, Bridge stockholders and Bridge OpCo unitholders will receive 0.07081 shares of Apollo stock for each Bridge Class A common stock share and each Bridge OpCo Class A common unit, with an agreed valuation of $11.50 per share or unit.

Law 360 M&A

FEBRUARY 24, 2025

ApolloGlobal Management said Monday it has agreed to buy Bridge Investment Group Holdings Inc., a Salt Lake City, Utah-based real estate investment manager, in a $1.5 billion deal steered by four law firms, as Apollo looks to expand its real estate equity and credit offerings.

JPAbusiness

FEBRUARY 24, 2025

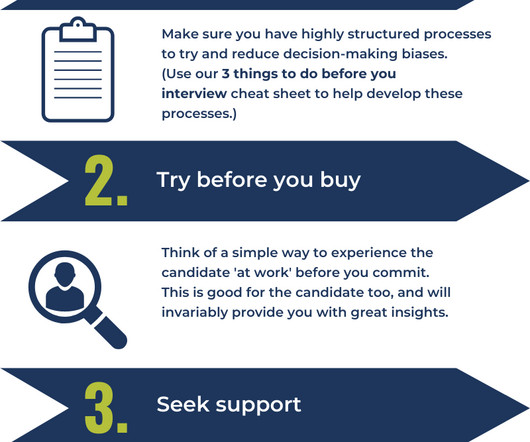

We all bring our own biases and prejudices to the task of hiring new staff and it's important to be aware of them. It's equally important to minimise the impact of these personal biases when making important decisions that will impact the future of your business. With this in mind we're sharing an infographic which has been designed to help take some of the emotion out of the hiring process.

Law 360 M&A

FEBRUARY 24, 2025

Pharmaceutical giant GSK said Monday that it has completed its acquisition of biopharma company IDRx Inc. in a deal worth up to $1.15 billion in cash to boost its treatment for gastrointestinal cancers.

The Guardian M&A

FEBRUARY 24, 2025

Food delivery groups board approves takeover by investor in German rival Delivery Hero Business live latest updates The food delivery business Just Eat Takeaway.com has been snapped up by an investor in its German rival Delivery Hero for 4.1bn (3.4bn), just two months after it left the London Stock Exchange. Just Eats board has unanimously approved the takeover by the South African-owned internet investor Prosus, in an all-cash deal six years after Prosusmade its first effort to buy the British

Let's personalize your content