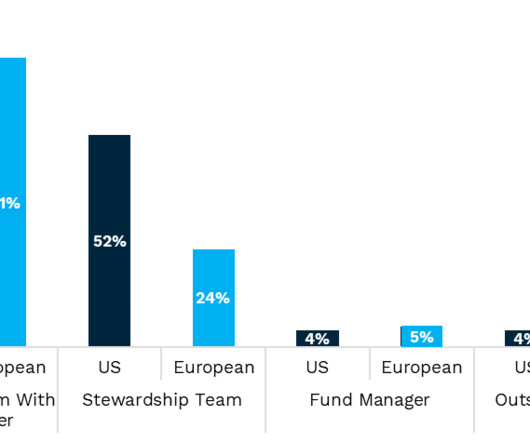

Is There a Difference Between How US and European Investors Approach Stewardship?

Harvard Corporate Governance

JANUARY 7, 2024

Posted by George Cowlrick, AQTION, on Sunday, January 7, 2024 Editor's Note: George Cowlrick is a Product Manager at AQTION. This post is based on an AQTION study by Mr. Cowlrick, Ali Saribas, and Andrew Brady. Related research from the Program on Corporate Governance includes Big Three Power, and Why it Matters (discussed on the Forum here ), Index Funds and the Future of Corporate Governance: Theory, Evidence and Policy (discussed on the Forum here ), and The Specter of the Giant Three (disc

Let's personalize your content