Prosus to acquire Just Eat Takeaway in €4bn deal

Financial Times M&A

FEBRUARY 23, 2025

Deal marks end to tumultuous few years for European food delivery group

Financial Times M&A

FEBRUARY 23, 2025

Deal marks end to tumultuous few years for European food delivery group

Butcher Joseph & Co.

FEBRUARY 23, 2025

The transportation, logistics, and energy storage sectors are undergoing profound transformation, driven by rapid technological advancements, evolving. The post Navigating M&A Trends in the Transportation, Logistics, and Energy Storage Space appeared first on ButcherJoseph & Co.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Appraisers Blog

FEBRUARY 23, 2025

Will be interesting to see if these waivers take off on any meaningful scale. I saw the agencies are now promoting hybrids, so it seems like they still want appraisers actually coming up with the value on the majority of their loans.

Mckinsey and Company

FEBRUARY 23, 2025

In the past few years, commodity traders focused on taking advantage of high volatility. Today, amid leaner industry margins, successful traders can maximize value from existing assets.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Law 360 M&A

FEBRUARY 23, 2025

National Grid said on Monday that it has agreed to sell its green subsidiary in the U.S. to Brookfield for $1.74 billion as the Canadian asset manager ups its stake in the rapidly growing renewables sector.

NYT M&A

FEBRUARY 23, 2025

He built a small chain of bakery cafes, with sourdough bread as its star. A few years after it was sold, it became nationally famous under a new name.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Musings on Markets

FEBRUARY 23, 2025

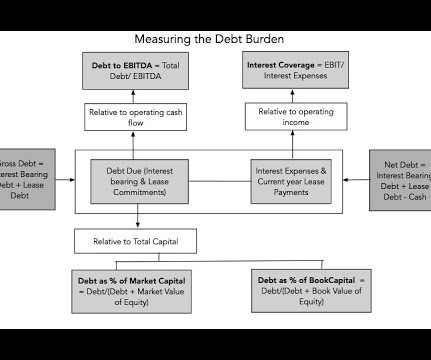

There is a reason that every religion inveighs against borrowing money, driven by a history of people and businesses, borrowing too much and then paying the price, but a special vitriol is reserved for the lenders, not the borrowers, for encouraging this behavior. At the same time, in much of the word, governments have encouraged the use of debt, by providing tax benefits to businesses (and individuals) who borrow money.

ThomsonReuters

FEBRUARY 23, 2025

The European e-invoicing market is on the brink of a major transformation, driven by mandatory e-invoicing and e-reporting regulations emerging across the EU. This shift, spurred by the need to improve VAT revenue collection and fueled by initiatives like the EU’s VAT in the Digital Age (ViDA), presents both challenges and opportunities for businesses.

Reynolds Holding

FEBRUARY 23, 2025

The Securities and Exchange Commission (SEC) staff recently updated its guidance on circumstances in which investors engaging with issuers on ESG and other matters can file a short-form Schedule 13G as a passive or institutional investor rather than a long-form Schedule 13D. The updates are in the form of a significant revision to Question 103.11 and the publication of a new Question 103.12 of the SECs Compliance and Disclosure Interpretationson Section 13(d) and Section 13(g) of the Exchange Ac

ThomsonReuters

FEBRUARY 23, 2025

Complexity and disruption those are the keywords when describing global trade and supply chain management in 2025, according to Thomson Reuters 2024 Global Trade Survey Report. The report is based on responses from upper-level trade professionals in North America, the European Union, the United Kingdom, Latin America, and Asia Pacific. Each of the 2024 surveys top themes is related to complexity and disruption in some way, with disruption in the supply chain being the primary concern for respo

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Reynolds Holding

FEBRUARY 23, 2025

Effective and well-designed laws governing investment and financial markets are the single most important foundation for financial markets to allocate capital efficiently while providing optimal reassurance to investors and lenders. Strong empirical evidence shows the United States has a lower cost of equity capital than comparable countries and that this lower cost is attributable in part to an institutional design that protects the independence of securities regulators and assures strong enfor

Let's personalize your content