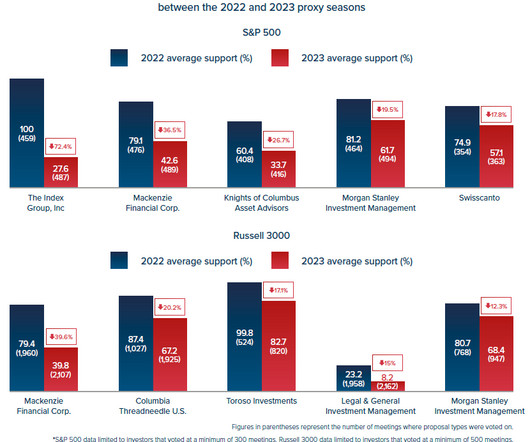

Strengthening pay practices

Harvard Corporate Governance

NOVEMBER 28, 2023

Posted by Will Arnot, Diligent Market Intelligence, on Tuesday, November 28, 2023 Editor's Note: Will Arnot is Senior Editorial Specialist at Diligent Market Intelligence (DMI). This post is based on DMI’s recent special report, Investor Stewardship 2023. Related research from the Program on Corporate Governance includes Stealth Compensation via Retirement Benefits and Paying for long-term performance (discussed on the Forum here ) both by Lucian Bebchuk and Jesse M.

Let's personalize your content