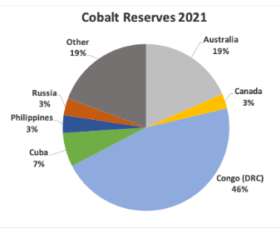

The Cobalt Conundrum: Net Zero Necessity vs Supply Chain Concerns

Harvard Corporate Governance

OCTOBER 18, 2022

Posted by Subodh Mishra, Institutional Shareholder Services, Inc., on Tuesday, October 18, 2022 Editor's Note: Subodh Mishra is Global Head of Communications at Institutional Shareholder Services, Inc. This post is based on an ISS ESG publication by Nicolaj Sebrell, CFA, Head of Energy, Materials, & Utilities; and Arthur Kearney, Associate, Metals & Mining, at ISS ESG, the sustainable investing arm of Institutional Shareholder Services.

Let's personalize your content