Risk rebalancing: Five important geopolitical-risk questions for CIOs

Mckinsey and Company

MAY 5, 2025

CIOs need to apply a much broader view of possible failure modes, where their assets are, and where the people who manage the assets are working.

Mckinsey and Company

MAY 5, 2025

CIOs need to apply a much broader view of possible failure modes, where their assets are, and where the people who manage the assets are working.

Financial Times M&A

MAY 5, 2025

Peabody formally notifies UK-listed miner of material adverse change affecting $3.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mckinsey and Company

MAY 5, 2025

The economic principles of valuation dont change that much, but McKinsey Partner Tim Koller explains why they remain more critical than ever as executives seek to address digital, geopolitical, climate, and other trends affecting their businesses.

Financial Times M&A

MAY 5, 2025

Acquisition by US oil and gas group comes against backdrop of strained relations between US and Canada

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

MAY 5, 2025

Innovation is a critical ingredient in any growth recipe. And the biggest growthboth for the innovator and the broader economycomes from revolutionary innovations.

Global Finance

MAY 5, 2025

Banks have been a cornerstone of economic expansion, providing essential credit to burgeoning industries, fostering greater financial inclusion, and helping the country move beyond its traditional agricultural base into sectors such as tourism, manufacturing and services. The transition has proved remarkably successful: the Dominican economy has experienced growth nearly three times the regional average for the past two decades.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Harvard Corporate Governance

MAY 5, 2025

Posted by Paul Rose (Case Western Reserve University), on Monday, May 5, 2025 Editor's Note: Paul Rose is Dean and Professor of Law at Case Western Reserve University School of Law. This post is based on his testimony in a hearing of the Subcommittee on Capital Markets of the House Committee on Financial Services. Today, two firmsInstitutional Shareholder Services (ISS) and Glass Lewisdominate over 90% of the proxy advisory market.

Fox Corporate Finance

MAY 5, 2025

FCF Fox Corporate Finance GmbH is delighted to publish the new FCF Healthcare & Life Sciences Venture Capital Monitor USA 03/2025. The Monitor is a monthly published overview of venture capital trends in. Read more The post FCF Healthcare & Life Sciences Venture Capital Monitor USA 03/2025 published appeared first on FCF Fox Corporate Finance GmbH.

Harvard Corporate Governance

MAY 5, 2025

Posted by Elizabeth Ising, Gibson, Dunn & Crutcher LLP, on Monday, May 5, 2025 Editor's Note: Elizabeth A. Ising is a Partner at Gibson, Dunn & Crutcher LLP. This post is based on her testimony in a hearing of the Subcommittee on Capital Markets of the House Committee on Financial Services. Chairman Wagner, Ranking Member Sherman and members of the Subcommittee, thank you for the invitation to testify today.

Financial Times M&A

MAY 5, 2025

Tie-up marks return to dealmaking for investment group after long search for a major target

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Harvard Corporate Governance

MAY 5, 2025

Posted by Paul Washington, Society for Corporate Governance, on Monday, May 5, 2025 Editor's Note: Paul Washington is President and CEO of the Society for Corporate Governance. This post is based on his testimony in a hearing of the Subcommittee on Capital Markets of the House Committee on Financial Services. Chair Wagner, Ranking Member Sherman, and Members of the Subcommittee, my name is Paul Washington, and I am the President and Chief Executive Officer of the Society for Corporate Governance

Financial Times M&A

MAY 5, 2025

Financier assumes effective control of Howard Hughes and will shift its strategy to hunt for acquisitions

Appraisers Blog

MAY 5, 2025

In reply to Baggins. Thanks Baggs…Id almost forgotten about that article. Got side tracked fighting phony complaints against appraisers for the next 6+ years!

Financial Times M&A

MAY 5, 2025

Deal with Vienna-based Erste Group cuts exposure to country with few connections to Spanish banks biggest markets

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Sun Acquisitions

MAY 5, 2025

Mergers and acquisitions (M&A) can be powerful tools for driving growth and creating value for businesses. However, realizing the full potential of a merger or acquisition requires careful planning and execution, particularly in the post-merger integration phase. By optimizing financial performance post-merger, companies can maximize the deal’s benefits and achieve their strategic objectives.

Law 360 M&A

MAY 5, 2025

Sunoco LP on Monday said it has agreed to buy Canadian gas station and refinery operator Parkland Corp. in a cash and equity deal worth approximately $9.1 billion, including assumed debt, a deal that greatly expands Sunoco's North American fuel distribution business.

BV Specialists

MAY 5, 2025

Historical financial performance plays a key role in appraising small businesses; however, not all years are created equal. Economic cycles, management changes, and external shocks can skew one year's numbers compared to others. That is where weighted average valuation comes in; a method that applies varying importance (or "weights") to different years to better reflect the company's true worth.

Benzinga

MAY 5, 2025

Elanco Animal Health Incorporated (NYSE: ELAN ) on Monday announced the sale of certain future tiered royalties and commercial milestones associated with Xdemvy (lotilaner ophthalmic solution) 0.25% for the human health application of lotilaner to Blackstone Life Sciences and Blackstone Credit & Insurance for $295 million in cash. The company will use the proceeds to accelerate debt reduction, positioning Elanco to achieve an expected net leverage ratio of 3.9x to 4.3x adjusted EBITDA by the

Financial Times M&A

MAY 5, 2025

Also in this newsletter: tariff threat to Surats gemstone and diamond industry, and Vidit Aatreys mantra

Benzinga

MAY 5, 2025

Footwear giant Skechers U.S.A. Inc. (NYSE: SKX ) stock is soaring on Monday. The company agreed to go private following its acquisition by global investment firm 3G Capital. The agreement offers shareholders $63.00 per share in cash , a 30% premium over Skechers' recent trading average or a blended option of cash and equity units in the post-transaction entity.

Financial Times M&A

MAY 5, 2025

The pair are combining their $40bn in personal fortunes and look to raise billions from outside investors

Law 360 M&A

MAY 5, 2025

Associated British Foods PLC said Tuesday that it is in talks to sell Allied Bakeries, a move that could lead to a kneading together of two leading bread brands.

Benzinga

MAY 5, 2025

Datadog Inc. (NASDAQ: DDOG ) announced Monday that it has acquired Eppo , a platform specializing in feature flagging and experimentation. The company will use the acquisition to enhance its Product Analytics suite and streamline the development process for its customers. Deal terms were not disclosed. The acquisition is designed to help developers, product managers, and analysts unify their tools and provide clearer insights into how new features and code changes affect business outcomes.

Law 360 M&A

MAY 5, 2025

A Ninth Circuit panel summarily refused to permit Meta Platforms Inc. users to immediately appeal a district court decision rejecting class certification for their antitrust case alleging the social media giant would have had to pay for their data if it didn't lie about privacy safeguards.

Peak Business Valuation

MAY 5, 2025

If you are preparing to buy, expand, or sell a flooring business , you need to determine the businesss true value. Identifying accurate valuation multiples is critical in this process. For reliable flooring business valuation multiples , it is best to receive a professional business valuation from a business appraiser. Additionally, a flooring business valuation can help you identify areas for improvement in your company.

Law 360 M&A

MAY 5, 2025

Jeld-Wen Inc. urged the Fourth Circuit to undo a landmark order forcing it to sell a manufacturing plant, saying a divestiture is no longer needed because the rival door maker that sued is no longer at risk of going out of business.

Benzinga

MAY 5, 2025

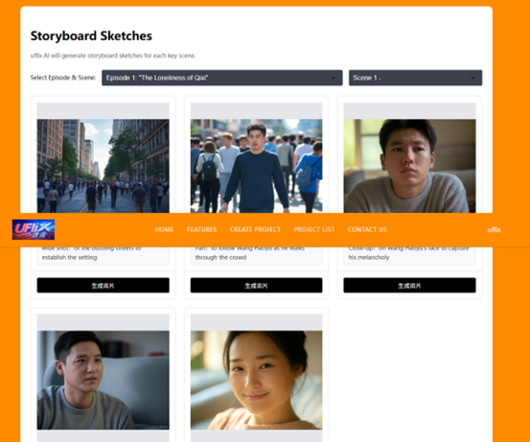

NEW YORK, May 05, 2025 (GLOBE NEWSWIRE) -- AB International Group Corp. (OTC: ABQQ ), an intellectual property (IP) and movie investment and licensing firm, announces its subsidiary AI+ Hubs Corp, a leading innovator in artificial intelligence and creative technology, is thrilled to announce the successful acquisition of theufilmAI intellectual property (IP) from a third-party developer.

Law 360 M&A

MAY 5, 2025

U.S. officials have asked a Manhattan federal court to extend deposition time in a lawsuit accusing Live Nation of anticompetitive practices in ticket sales to live entertainment events, saying they need more hours to seek testimony from several entities and individuals who were recently disclosed in the case.

Benzinga

MAY 5, 2025

Pershing Square 's Bill Ackman wants to turn Howard Hughes Holdings Inc (NYSE: HHH ) into a “modern-day Berkshire Hathaway.” “[When] I came into this business, the first book I read was Ben Graham’s ‘[The] Intelligent Investor.’ The next thing I read was basically Berkshire Hathaway shareholder letters,” Ackman said Monday on CNBC’s Squawk Box. “I always sort of aspired to build a diversified holding company and turn it into a valuable e

Law 360 M&A

MAY 5, 2025

Clifford Chance LLP has added a Paul Weiss Rifkind Wharton & Garrison LLP transactional attorney in New York as co-chair of its U.S. executive compensation practice, the firm announced Monday.

Benzinga

MAY 5, 2025

Howard Hughes Holdings Inc. (NYSE: HHH ) shares traded higher premarket on Monday. The company disclosed an agreement with Pershing Square to invest $900 million to acquire 9,000,000 newly issued HHH shares. Hedge fund titan Bill Ackman 's Pershing Square’s $100 per share acquisition of HHH stock represents a 48% premium over the closing price on Friday, May 2, 2025.

Law 360 M&A

MAY 5, 2025

A former top Meta executive for Facebook Messenger and Instagram provided limited backing Monday for Federal Trade Commission allegations the company bought WhatsApp and Instagram to squelch competition, telling a D.C. federal judge that while he saw messaging apps as a real threat, those worries didn't include WhatsApp.

Benzinga

MAY 5, 2025

Sunoco LP (NYSE: SUN ) shares are trading lower on Monday after the company agreed to acquire Parkland Corporation (OTC: PKIUF ) in a deal valued at approximately $9.1 billion, including debt. The transaction, announced Monday, involves a mix of cash and equity and will create a new entity called Sunoco LP (NYSE: SUN ) shares are trading lower on Monday after the company agreed to acquire Parkland Corporation (OTC: PKIUF ) in a deal valued at approximately $9.1 billion, including debt.

Law 360 M&A

MAY 5, 2025

Counsel for the owners of Heritage Coal told a Delaware bankruptcy judgeon Monday that if secured and unsecured creditors cannot reach a deal by Tuesday, the company will have to move to convert its bankruptcy from a Chapter 11 to a Chapter 7 liquidation.

Let's personalize your content