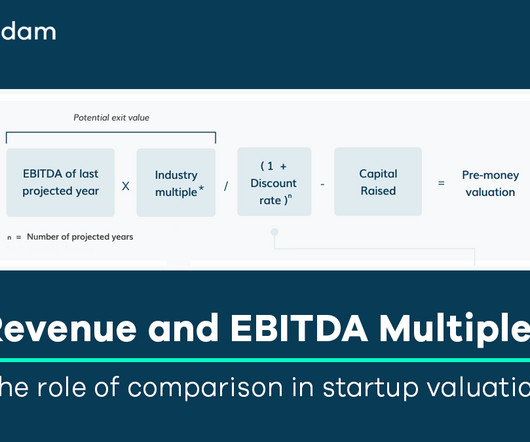

Revenue and EBITDA Multiples: The role of comparison in startup valuation

Equidam

JULY 30, 2024

Imagine comparing products in the supermarket, where different box sizes and a range of pricing may make it hard to determine the value; labels that give you the price per kg of product can greatly simplify that process. A shortcut that many investors attempt to use is to apply a multiple.

Let's personalize your content