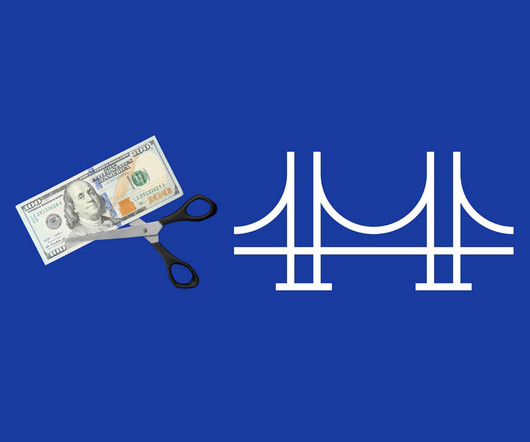

Net Debt Bridge – Concept and Formula Explained

Valutico

MARCH 12, 2024

For private companies, this is estimated using methods like discounted cash flow analysis or comparisons to similar transactions and peers. Short summary The Net Debt Bridge is a critical aspect of company valuation, particularly during mergers, acquisitions, or financial analysis. What is the net debt bridge?

Let's personalize your content