Discount Rate—Explanation, Definition and Examples

Valutico

FEBRUARY 27, 2024

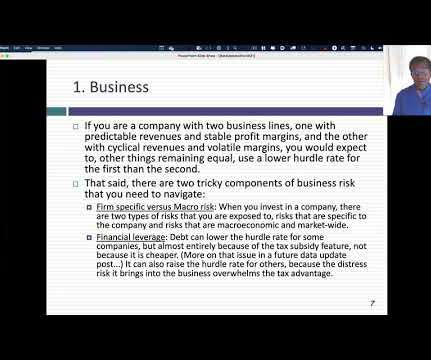

To refine the selection of the discount rate, it’s important to draw on inputs from credible sources regarding economic, industry and company specific risk factors. Capital Asset Pricing Model (CAPM): According to CAPM, the expected return on a stock has two main components: the risk-free rate and a risk premium.

Let's personalize your content