In Search of Safe Havens: The Trust Deficit and Risk-free Investments!

Musings on Markets

AUGUST 15, 2023

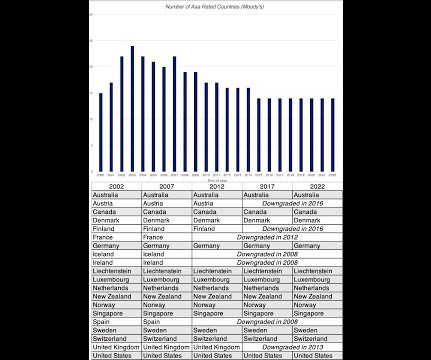

In fact, the standard practice that most analysts and investors follow to estimate the risk free rate is to use the government bond rate, with the only variants being whether they use a short term or a long term rate. What is a risk free investment? Why does the risk-free rate matter?

Let's personalize your content