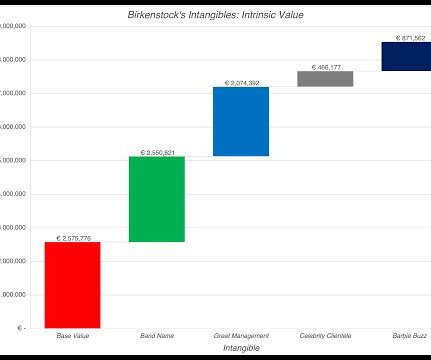

Invisible, yet Invaluable: Valuing Intangibles in the Birkenstock IPO!

Musings on Markets

OCTOBER 6, 2023

The Value of Intangible Assets Accounting has historically done a poor job dealing with intangible assets, and as the economy has transitioned away from a manufacturing-dominated twentieth century to the technology and services focused economy of the twenty first century, that failure has become more apparent.

Let's personalize your content