Catastrophic Risk: Investing and Business Implications

Musings on Markets

FEBRUARY 16, 2024

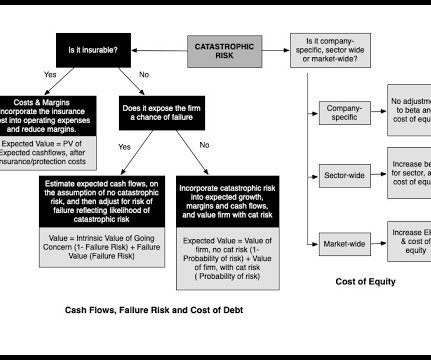

Intrinsic Value Effect : The calculations for cashflows are identical to those done when the risks are company-specific, with cash flows estimated with and without the catastrophic risk, but since these risks are sector-wide or market-wide, there will also be an effect on discount rates. at the end of 2007 to 0.85

Let's personalize your content