What is Beta in Finance, and why is it Essential for a Business Valuation?

Equilest

JULY 31, 2022

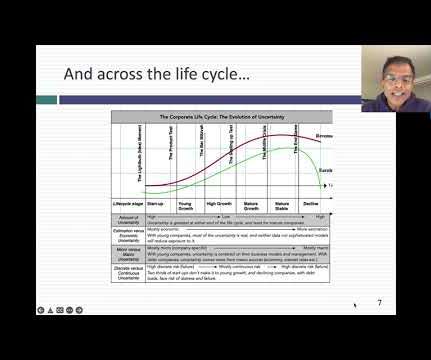

What is Beta in Finance, and why is it essential for a business valuation? Are you considering evaluating a business using an excel template without understanding Beta in Finance? In statistics, beta is defined as the slope of a straight line. The beta measures the return of the stock relative to the market return.

Let's personalize your content