How a New Regulatory Framework Could Contain Bank Runs and Promote Recovery

Reynolds Holding

APRIL 10, 2024

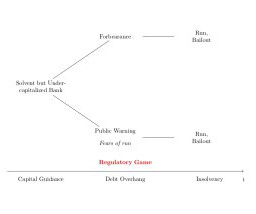

Since the collapse of SVB, Credit Suisse, and other smaller banks that year, many reform proposals have focused on stronger ex-ante prudential measures, such as higher capital and liquidity rules ( Admati et al., Both measures represent a form of preventive, partial bail-in to preserve going-concern value for solvent intermediaries.

Let's personalize your content