How to Get a BSPCE Valuation for Your Startup’s Employee Share Plan

Equidam

JUNE 10, 2025

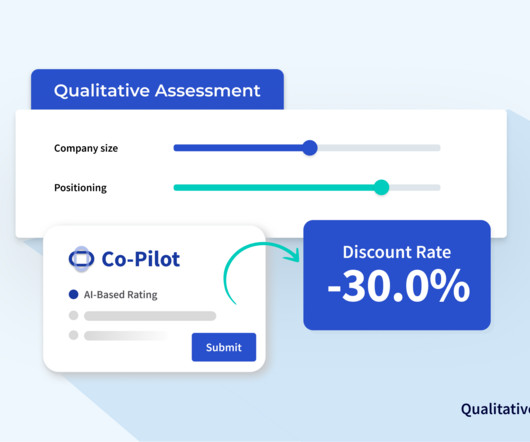

This guide explains what BSPCEs are, how they compare to other equity incentives (like free shares/AGA, stock options, or RSUs), and the process of obtaining a BSPCE valuation. This win-win tax treatment for both employee and employer is why BSPCEs are considered one of the most favorable equity schemes in Europe.

Let's personalize your content