The (Uncertain) Payoff from Alternative Investments: Many a slip between the cup and the lip?

Musings on Markets

JUNE 17, 2025

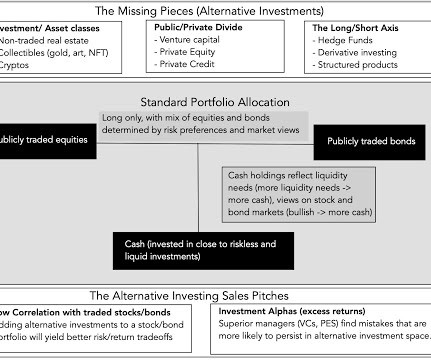

The first is that they have low correlations with financial assets (stocks and bonds), allowing for diversification benefits and the second is investments in some of these alternative asset groupings have the potential to earn excess returns or alphas.

Let's personalize your content