ESG Performance Metrics in Executive Pay

Harvard Corporate Governance

JANUARY 15, 2024

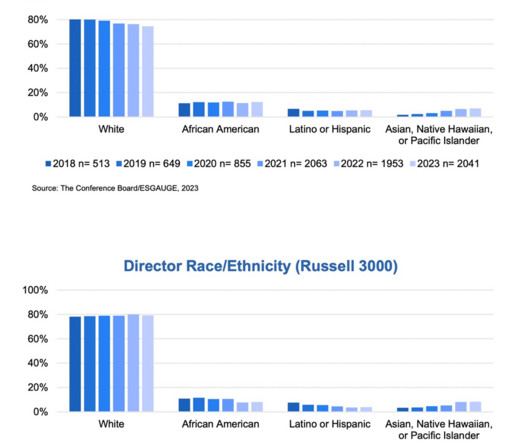

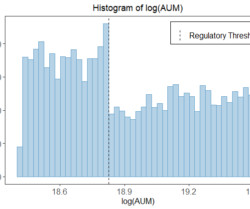

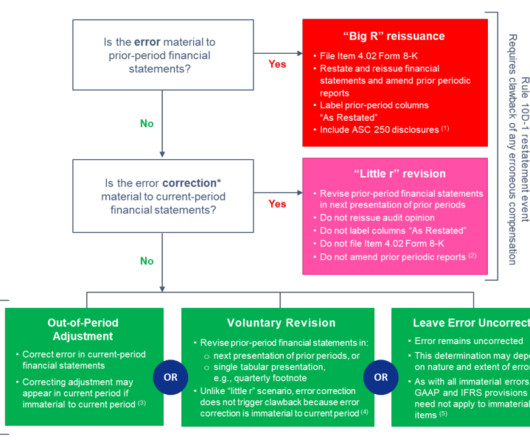

This post is based on Normal 0 false false false EN-US X-NONE X-NONE CEO and Executive Compensation Practices in the Russell 3000 and S&P 500: Live Dashboard , a live online dashboard published by The Conference Board and ESG data analytics firm ESGAUGE , in collaboration with compensation consulting firm FW Cook.

Let's personalize your content