Data Update 8 for 2025: Debt, Taxes and Default - An Unholy Trifecta!

Musings on Markets

FEBRUARY 23, 2025

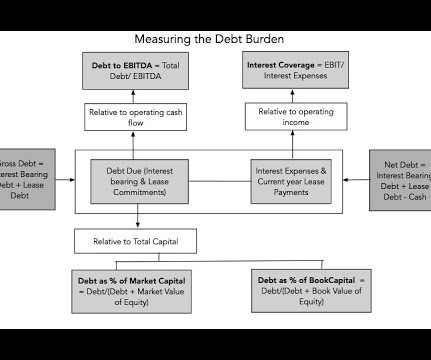

The debt equity trade off, in frictional terms, is in the picture below: As you look through these trade offs, real or frictional, you are probably wondering how you would put them into practice, with a real company, when you are asked to estimate how much it should be borrow, with more specificity.

Let's personalize your content