Demystifying Valuation Clauses in LPAs for Emerging Managers

Equidam

JULY 23, 2025

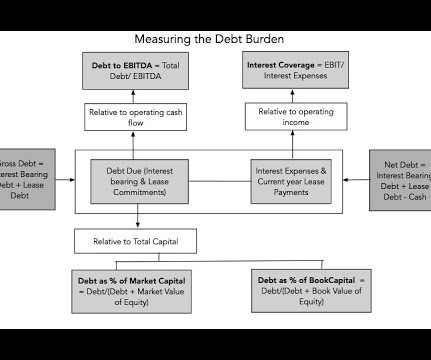

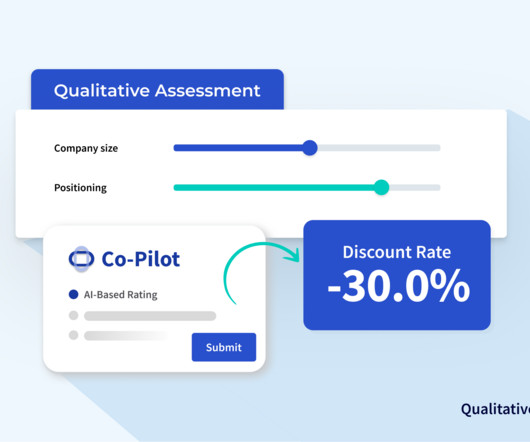

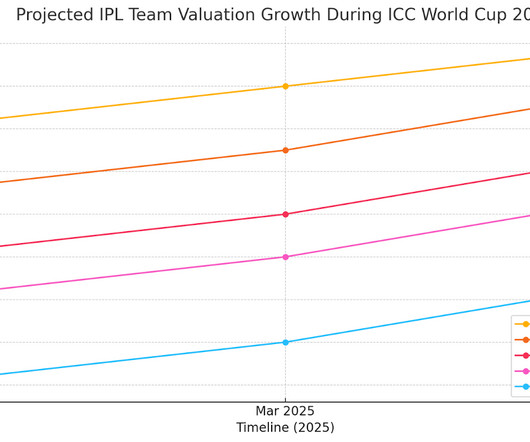

Especially for early-stage startups, there are multiple methods one could use – cost basis, last round price, discounted cash flow, comparables, you name it. LPs in 2025 want to be “more operationally engaged” and have more visibility into fund execution, and valuation oversight is part of that bigger trend.

Let's personalize your content