Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

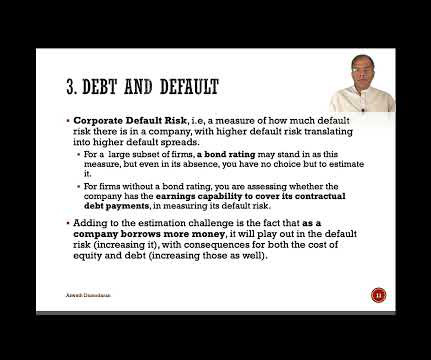

In this context, the cost of capital become a measure of the cost of funding a business: In dividend decision s, i.e., the decisions of how much cash to return to owners and in what form (dividends or buybacks), the cost of capital is a divining rod. In data update 4 , I looked at movements in corporate default spreads during 2024.

Let's personalize your content