Disagreements and First Principles: The Pushback on my Tesla Valuation

Musings on Markets

FEBRUARY 2, 2023

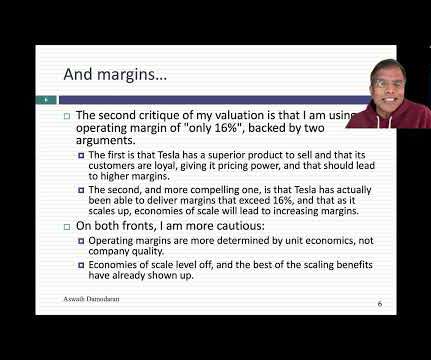

A few of you did take issue with the fact that the growth rate that I used for the first five years dropped from 35%, in my November 2021 valuation , to 24%, in my most recent one. There is not much room to maneuver on either number, since half of all US companies have costs of capital between 7.3% It was the reason that I argued at a $1.2

Let's personalize your content