Data Update 5 for 2022: The Bottom Line!

Musings on Markets

FEBRUARY 27, 2022

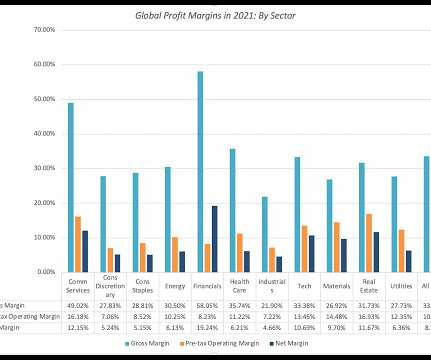

That said, about 31% of the net profits of all publicly traded firms listed globally in 2021 were generated by financial service firms; that percent is lower in the US and higher in emerging markets. To make comparisons, profits are scaled to common metrics, with revenues and book value of investment being the most common scalar.

Let's personalize your content