Data Update 4 for 2021: The Hurdle Rate Question!

Musings on Markets

FEBRUARY 10, 2021

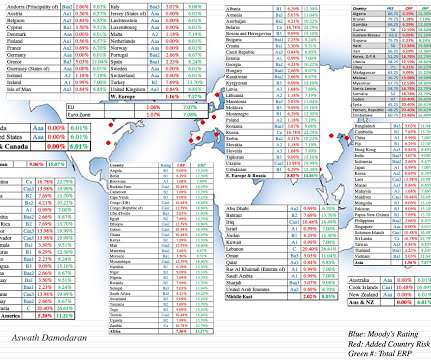

I know that many of you are not fans of modern portfolio theory or betas, but ultimately, there is no way around the requirement that you need to measure how risky a business, relative to other businesses. (More on that issue in a future data update post.) US , Europe , Emerging Markets , Japan , Australia/NZ & Canada , Global ) 2.

Let's personalize your content