The Relevance of Historical and Forecast Periods in a Business Valuation

Equilest

JULY 20, 2025

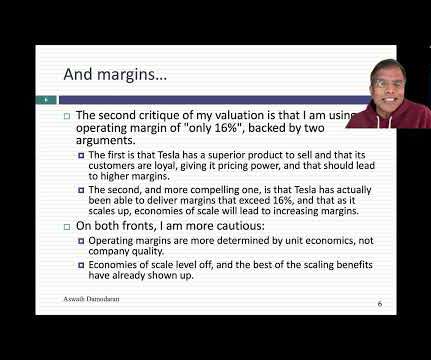

Assumptions Forecast Period: 2023–2027 WACC: 10% Terminal Growth Rate: 3% Final Year FCFF (2027): $1.8M Flat Terminal Growth Assumptions : Even modest changes from 2% to 3% drastically affect terminal value. ? Example: Historical Data of XYZ Co. Infographic: Components of DCF Valuation ?

Let's personalize your content