Data Update 8 for 2025: Debt, Taxes and Default - An Unholy Trifecta!

Musings on Markets

FEBRUARY 23, 2025

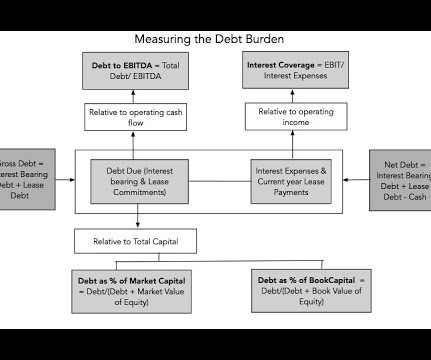

Using this distinction, all interest-bearing debt, short term and long term, clears meets the criteria for debt, but for almost a century, leases, which also clearly meet the criteria (contractually set, limited role in management) of debt, were left off the books by accountants.

Let's personalize your content