Review the concept of WACC

Andrew Stolz

MARCH 20, 2020

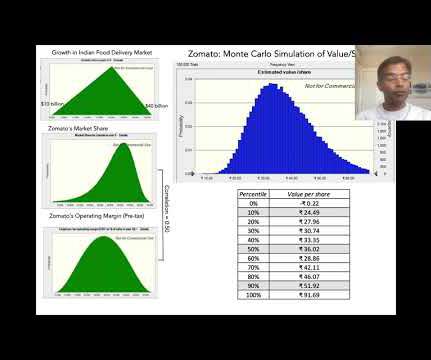

This is a Valuation Master Class student essay by Teeradon Piyakiattisuk from March 19, 2019. The formula implies the return an investor expects from a risk-free investment plus the return from the stock in relation to market volatility. The market risk premium is calculated from a market rate of return less a risk-free rate.

Let's personalize your content