Breaking Ties: Kraft Heinz Closes Business Operations in Russia

Valutico

APRIL 24, 2023

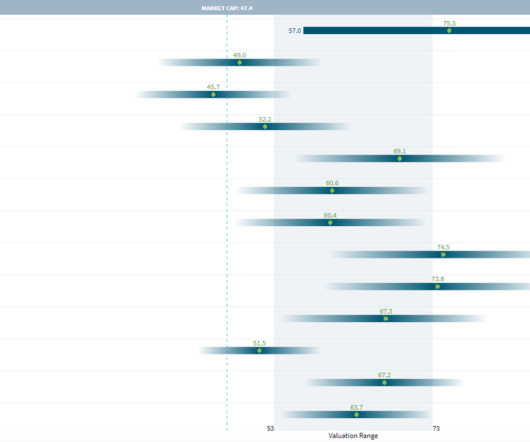

Recent M&A deals KHC has been making headlines with strategic moves like acquiring Cerebos Pacific in 2018 and selling off assets such as its Indian nutritional beverage and Canadian natural cheese businesses in 2019. Net income increased 131.3% Adjusted EBITDA decreased 5.8% billion in 2020. billion using a WACC of 6.3%.

Let's personalize your content