Chancery Invalidates Elon Musk’s $55.8 Billion Equity Compensation Package

Harvard Corporate Governance

FEBRUARY 21, 2024

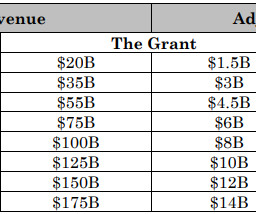

1] The plaintiff-stockholders alleged that Tesla’s directors breached their fiduciary duties by awarding Musk performance-based stock options in January 2018 with a potential $55.8 A February 8, 2018 proxy statement (the “Proxy”) notified stockholders of a vote on the Grant, which was held on March 21, 2018. Tornetta et al.

Let's personalize your content