Patria Investments Signs Agreement to Acquire Credit Suisse's Real Estate Business in Brazil

Benzinga

DECEMBER 6, 2023

The funds represent permanent capital AUM with significant scale, with four funds each having a market capitalization over R$1.5

Benzinga

DECEMBER 6, 2023

The funds represent permanent capital AUM with significant scale, with four funds each having a market capitalization over R$1.5

Musings on Markets

NOVEMBER 9, 2021

If you are interested, you can see my valuations from 2014 , 2016 and 2017. In sum, the company's market cap has risen from $2.8 In sum, the company's market cap has risen from $2.8 Tesla: The Back Story I first valued Tesla in 2013 , as a "luxury automobile company" and I have valued almost every year since.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

FEBRUARY 27, 2022

The largest sector, in the US, in terms of market capitalization, is information technology and I have argued that tech companies age in "dog years" , with compressed life cycles. Not surprisingly, then, the net effect of growth will depend on how much is reinvested back, relative to what the company can harvest as future growth.

Musings on Markets

NOVEMBER 4, 2022

Investors, used to a decade of better-than-expected earnings and rising stock prices at these companies, have been blindsided by unexpected bad news in earnings reports, and have knocked down the market capitalization of these companies by hundreds of billions of dollars in the last few weeks.

Musings on Markets

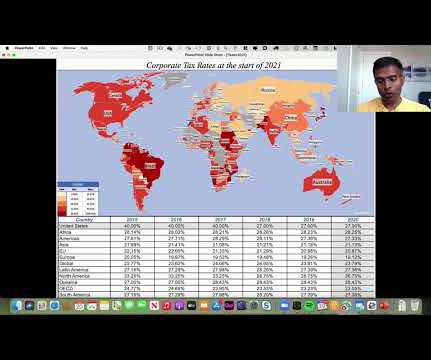

APRIL 20, 2021

I will begin by laying out the pathways through which corporate taxes affect company value, and then looking at how the 2017 tax reform act, which lowered the federal tax rate from 35% to 21%, has affected corporate behavior. In a more telling statistic, the dollar value of taxes paid increased between 2017 and 2019 by 1.4%

Musings on Markets

OCTOBER 25, 2022

An intuitive reading of the FCFE is that it is cash available to be returned to equity investors, either in the form of dividends or as cash buybacks. It is the rare firm that follows a residual cash policy, returning its FCFE every year as dividends and/or buybacks.

Let's personalize your content