Beta?! Not just Beta - The Levered Beta!

Equilest

JANUARY 1, 2023

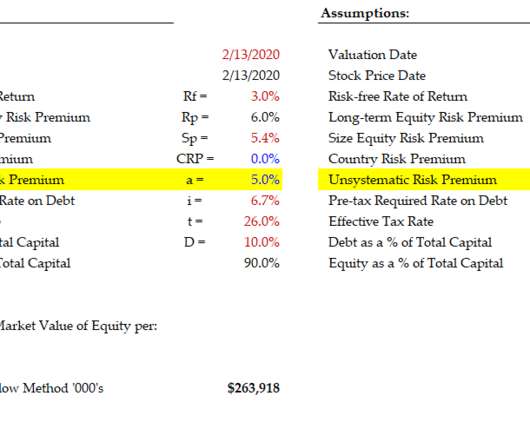

Because of the Levered-Beta (Known also as the Leveraged Beta). . What is Beta? Beta describes the firm's sensitivity to what is happening in the market. Aggressive industries are more sensitive to the market situation—for example - real estate, aviation, and automobile. The answer - is not necessary!

Let's personalize your content