Discount Rate—Explanation, Definition and Examples

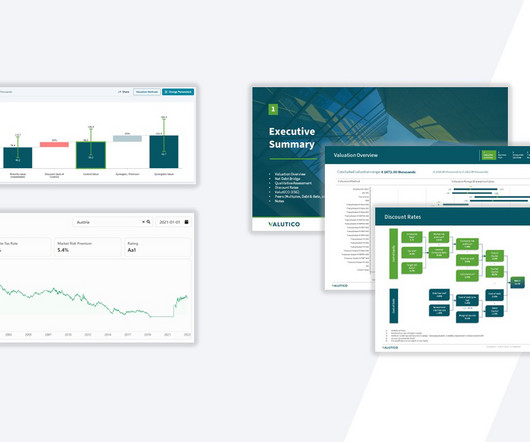

Valutico

FEBRUARY 27, 2024

Key takeaways: The discount rate is primarily used by central banks to manage the economy and investors to calculate the present value of future cash flows from an investment. Investment Discount Rate: In investment analysis, the discount rate is employed to calculate the present value of future cash flows.

Let's personalize your content