Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

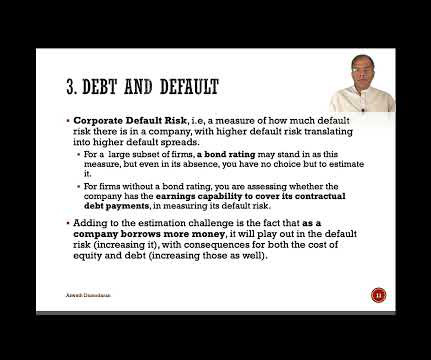

In the first five posts, I have looked at the macro numbers that drive global markets, from interest rates to risk premiums, but it is not my preferred habitat. The second set of inputs are prices of risk, in both the equity and debt markets, with the former measured by equity risk premiums , and the latter by default spreads.

Let's personalize your content