Data Update 2 for 2024: A Stock Comeback - Winning the Expectations Game!

Musings on Markets

JANUARY 17, 2024

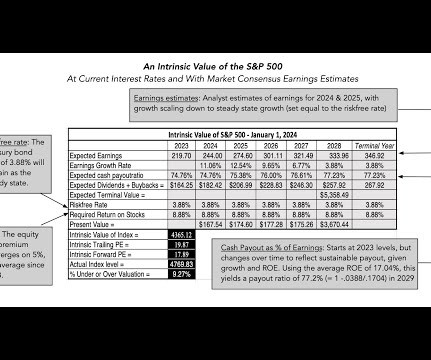

Heading into 2023, US equities looked like they were heading into a sea of troubles, with inflation out of control and a recession on the horizon. Breaking equities down by sub-region, and looking across the globe, I computed the change in aggregate market capitalization, by region: While US stocks accounted for about $9.5

Let's personalize your content