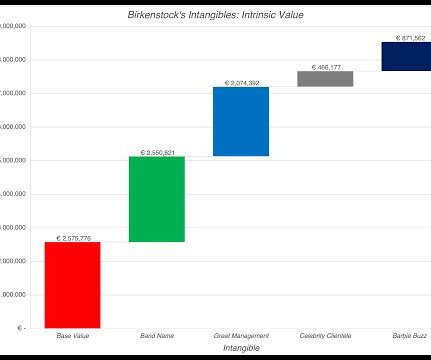

Invisible, yet Invaluable: Valuing Intangibles in the Birkenstock IPO!

Musings on Markets

OCTOBER 6, 2023

In this post, I will look at another initial public offering, Birkenstock, that is likely to get more attention in the next few weeks, given that it is targeting to go public at a pricing of about €8 billion, for its equity, in a few weeks.

Let's personalize your content