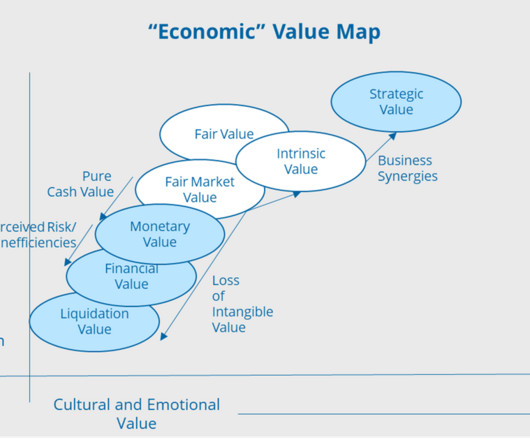

Transcending Fair Market Value

Value Scope

APRIL 9, 2021

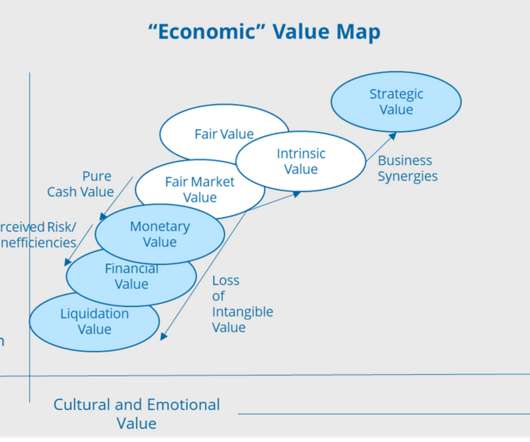

Click to Download: Transcending Fair Market Value Transcending Fair Market Value “Beauty is in the eyes of the beholder.” 1] But the concept of value is complex. 1] But the concept of value is complex. intrinsic value, fair value, fair market value).

Let's personalize your content