Stewardship in AQTION: How the World’s Largest Investors Handle Their Assets

Harvard Corporate Governance

MAY 24, 2025

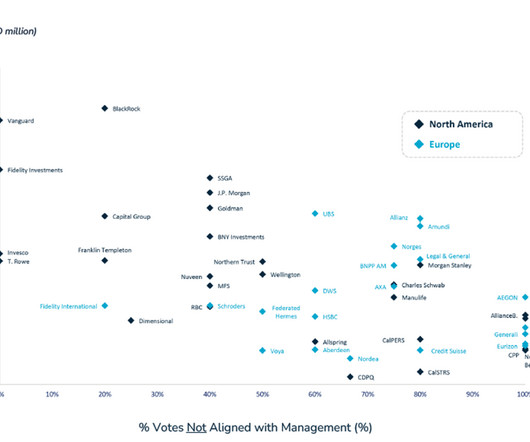

Posted by Ali Saribas, AQTION, on Saturday, May 24, 2025 Editor's Note: Ali Saribas is a Partner at AQTION. This post is based on his AQTION study. AQTION, leveraging its proprietary database powered by SquareWell Partners, published its second review on how the worlds largest 65 investors (hereafter referred to as the Top 65) are evaluating governance and sustainability issues and stewarding their portfolios.

Let's personalize your content