DOJ Reinforces Demand to Break Up Google’s Search Monopoly

NYT M&A

MARCH 7, 2025

In a court filing on Friday, the government signaled a continuation of tough regulatory pressure on the search giant.

NYT M&A

MARCH 7, 2025

In a court filing on Friday, the government signaled a continuation of tough regulatory pressure on the search giant.

Auto Dealer Valuation Insights

MARCH 7, 2025

Because of the popularity of this post, we revisit it this week. Originally published in 2019, this post is as a guide for mineral owners who are seeking to learn more about what they own. As we’ve discussed, there are plenty of factors to consider when determining the value of mineral interests.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Financial Times M&A

MARCH 7, 2025

Several years after debt-fuelled takeovers the supermarket chains are grappling with high interest payments and shrinking sales

Appraisers Blog

MARCH 7, 2025

In reply to Baggins. Hey Bags – my website is built and managed by SFREP – also my software vendor. “Keeping the Reality in Real Estate” is mine and trademarked – thanks for noticing.

Speaker: Susan Spencer, Principal of Spencer Communications

Intent signal data can go a long way toward shortening sales cycles and closing more deals. The challenge is deciding which is the best type of intent data to help your company meet its sales and marketing goals. In this webinar, Susan Spencer, fractional CMO and principal of Spencer Communications, will unpack the differences between contact-level and company-level intent signals.

Mckinsey and Company

MARCH 7, 2025

US consumers have become more active in their healthcare decisions and are seeking engagement from healthcare organizations. Addressing these trends can improve healthcare businesses results.

NYT M&A

MARCH 7, 2025

The design tech company is exploring a public offering after regulators stymied its $20 billion sale to the software giant Adobe in 2023.

Business Valuation Zone brings together the best content for business valuation professionals from the widest variety of industry thought leaders.

Mckinsey and Company

MARCH 7, 2025

After ten years of sustained, continuous improvement, a new set of sophisticated challenges led SQM to merge operational excellence with innovative technology. The result: a performance breakthrough.

Financial Times M&A

MARCH 7, 2025

Sycamore may want to split up Walgreens but previous attempts to offload the high street chemist have failed

Mckinsey and Company

MARCH 7, 2025

About 4.7 billion people are below the economic empowerment line meaning they cant afford the daily basics essential for a decent quality of life. The problem is concentrated in lower- and middle-income economies, but about 270 million live in high-income economies, surrounded by prosperity. While governments are key to reducing poverty and raising living standards, the private sector can tailor initiatives to economically empower more people, write Kweilin Ellingrud and Kevin Russell in World

Law 360 M&A

MARCH 7, 2025

Elon Musk has agreed to sit for a deposition in early April in a proposed shareholder class action accusing him of fraudulently claiming Twitter had a bot problem to get out of his $44 billion acquisition of the site, his attorneys said Friday.

Speaker: Wayne Spivak - President and Chief Financial Officer of SBA * Consulting LTD, Industry Writer, and Public Speaker

The old adages that "cash is king" and "you can’t spend profits" still hold true today. But however well-known these sayings might be, it requires a change in mindset to properly implement a cash flow management system that predicts your business's runaway as accurately as possible. Key to this new mindset is understanding the difference between the Statement of Cash Flows, a historical look at the source and uses of cash, and the Cash Flow Statement, which uses transaction history and forward-l

Class VI Partner

MARCH 7, 2025

Key insights Valuing a manufacturing business involves more than just examining revenue and profits. Manufacturing businesses have unique valuation challenges due to their reliance on machinery, equipment, and inventory. Understanding how to value these assets is essential, especially if you plan to sell your business within the next few years.

Law 360 M&A

MARCH 7, 2025

A group of Illinois towns told the D.C. Circuit on Friday that federal regulators relied on flawed train traffic data to approve Canadian Pacific's $31 billion merger with Kansas City Southern, failing to account for significant public safety and environmental harms to Windy City communities.

Vested

MARCH 7, 2025

When gearing up for a funding round, startup founders can often get lost in the world of valuations, investment documents, pitch deck preparation, and how to find the best investors.

Law 360 M&A

MARCH 7, 2025

A Texas federal judge on Friday granted an early win to Anadarko Petroleum's severance plan and benefits committee in an ex-executive's suit alleging he was owed severance after an acquisition by Occidental Petroleum in 2019, finding the petroleum giant's decision to deny benefits wasn't an abuse of discretion.

Speaker: Joe Apfelbaum, CEO of Ajax Union

In this webinar, Joe Apfelbaum, CEO of Ajax Union and business strategist, will take you through the ABCs of intent data. You'll learn how to effectively use it to drive business results, with practical tips on how to leverage both company and contact intent data to maximize your marketing efforts. Whether you're a seasoned marketer or just getting started, this webinar is a must-attend for anyone looking to stay ahead in the ever-evolving world of digital marketing.

Mckinsey and Company

MARCH 7, 2025

With their working-age populations shrinking, many emerging economies are set to experience the same demographic problems plaguing developed countries. They must act now to prepare for the moment when their demographic dividend fades and the burden of supporting an older population becomes unavoidable, write Anu Madgavkar and Marc Canal Noguer in Project Syndicate.

Law 360 M&A

MARCH 7, 2025

While recent high-profile corporate moves out of Delaware have prompted discussion about the benefits of incorporation elsewhere, for many, remaining in the First State may be the right decision due to its deep body of business law, tradition of nonjury trials and other factors, say attorneys at Goodwin.

Appraisers Blog

MARCH 7, 2025

Empowering Appraisers: Leveraging AI and HUD Guidelines to Uphold Professional Integrity By Kenneth J. Mullinix In recent years, appraisers have faced increasing scrutiny from agencies like the Department of Housing and Urban Development (HUD). While oversight is essential, there are growing concerns about investigations that disregard established protocols, leading to prolonged and unwarranted scrutiny.

Law 360 M&A

MARCH 7, 2025

There's no debate that activist investor campaigns have increasingly taken aim at CEOs, but attorneys on a Friday panel at the annual Tulane Corporate Law Institute were sometimes at odds on the activists' motivations.

Global Finance

MARCH 7, 2025

The oil giant cut its dividend to balance shareholder payouts with rising capital investments amid lower crude prices and evolving market conditions. Saudi Arabian Oil, better known as Aramco, is recalibrating its dividend strategy as it navigates weaker oil prices and rising capital investment demands. The worlds largest oil and gas producer plans to distribute $85.4 billion in dividends this yeardown about 30% from $124.3 billion in 2024reflecting a shift in financial priorities.

Law 360 M&A

MARCH 7, 2025

Insignia Financial on Friday said that it agreed to open its books to Bain Capital and CC Capital after the two bidders increased their respective takeover offers to $3.34 billion Australian (US$2.11 billion) amid a bidding war.

The Guardian M&A

MARCH 7, 2025

Walgreens Boots Alliance sold to Sycamore Partners and ends almost a century of trading on public markets The US owner of the high street pharmacy chain Boots is to be taken private in a $10bn (7.8bn) deal that will bring an end to almost a century of trading on public markets for Walgreens Boots Alliance. The company, which operates about 1,900 Boots stores in the UK, has been sold to the US private equity firm Sycamore Partners after struggling in the internet era as customers have turned to o

Law 360 M&A

MARCH 7, 2025

The estate of food storage company Tupperware Brands can solicit votes on its Chapter 11 liquidation plan, even as its creditors accused the debtor's latest plan of deviating from a prior agreement.

Mckinsey and Company

MARCH 7, 2025

Diversity, equity, and inclusion (DEI) is grabbing a lot of headlines, but lets look beyond the latest debates to understand some labor market dynamics that can help employers hire and retain talent to meet business needs. New research from the McKinsey Global Institute compares womens and mens work experiences to better understand the tough trade-offs at play in the world of work, writes Kweilin Ellingrud in Forbes.

Law 360 M&A

MARCH 7, 2025

Bankrupt electric vehicle and hydrogen fueling technology maker Nikola Corporation received approval Friday in Delaware for its proposed bidding procedures, which seek to conduct an auction for its asset in a month's time.

Mckinsey and Company

MARCH 7, 2025

The headlines are consistent: The gender pay gap has narrowed, but American women who work full time still make only 84 cents for every dollar men do. Thats certainly better than at the turn of the centurywhen it was 77 centsbut far short of parity. So, is this proof of continuing workplace discrimination? Not so much, says new research from the McKinsey Global Institute (MGI), write Anu Madgavkar and Sven Smit in Fortune.

Law 360 M&A

MARCH 7, 2025

A Texas bankruptcy judge Friday gave Steward Health Care the go-ahead to turn over responsibility for transition services for the dozens of hospitals it has sold during its Chapter 11 case to another hospital chain.

Auto Dealer Valuation Insights

MARCH 7, 2025

Succession planning has been an area of increasing focus in the RIA industry, particularly given what many are calling a looming succession crisis. The industry’s demographics suggest that increased attention to succession planning is well warranted: a majority of RIAs are still led by their founders, and only about a quarter of them have non-founding shareholders.

Law 360 M&A

MARCH 7, 2025

A new bill recently introduced in the California Senate revives last year's attempt to increase oversight of healthcare transactions involving private equity groups and hedge funds, meaning that attorneys may soon need to assess the compliance status of existing management relationships and consider modifying contract terms, says Andrew Demetriou at Husch Blackwell.

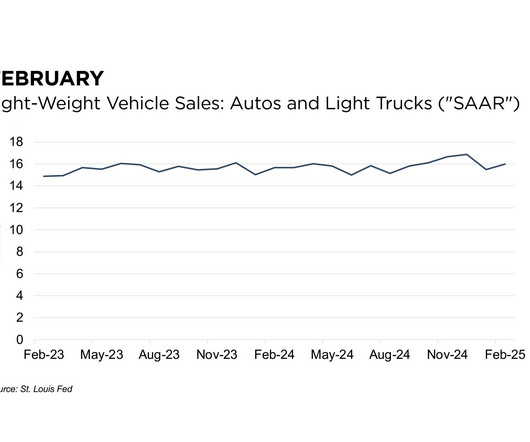

Auto Dealer Valuation Insights

MARCH 7, 2025

The February 2025 SAAR came in at 16.0 million units, up 3.2% from last month and 2.1% from February 2024. While February typically records one of the lowest sales volumes each year, this month’s SAAR exceeded the average of the last five Februarys (approximately 15.3 million units).

Law 360 M&A

MARCH 7, 2025

Arthur J. Gallagher & Co. announced Friday that federal regulators requested additional information, for a second time, on its $13.5 billion acquisition of independent insurance brokerage AssuredPartners, extending the waiting period under the Hart-Scott-Rodino Act until 30 days after the firm complies with the request.

Peak Business Valuation

MARCH 7, 2025

The lumber and building materials industry plays a key role in construction and home improvement. With the rise in demand for housing, repairs, and renovations , many are considering working in this industry. If you are looking to buy a lumber and building material store , understanding its value is essential. A valuation for buying a lumber and building material store is an effective way to learn the true value of a business.

Law 360 M&A

MARCH 7, 2025

After some initial uncertainty, the new Hart-Scott-Rodino Act rules did go into effect last month, and though their increased information requirements create greater initial burdens for merging parties, the rules should lead to greater certainty and predictability through a more efficient and effective review process, says Craig Malam at Edgeworth Economics.

Benzinga

MARCH 7, 2025

In a strategic move aligning with Delaware's shift toward adult-use cannabis, multi-state cannabis operator MariMed Inc. (OTCQX: MRMD ) has completed its acquisition of First State Compassion Center (FSCC), the state's leading cannabis operator. This deal, originally structured in a July 2023 Omnibus Agreement, enables MariMed to fully integrate FSCC's cultivation, processing, and retail assets into its vertically integrated operations.

Law 360 M&A

MARCH 7, 2025

In this week's Taxation With Representation, Walgreens Boots Alliance goes private via a deal with Sycamore Partners, Honeywell buys Sundyne from Warburg Pincus, and Jazz Pharmaceuticals acquires Chimerix.

Let's personalize your content