CEO Pay Trends: A Post Proxy Season Recap

Harvard Corporate Governance

JUNE 17, 2025

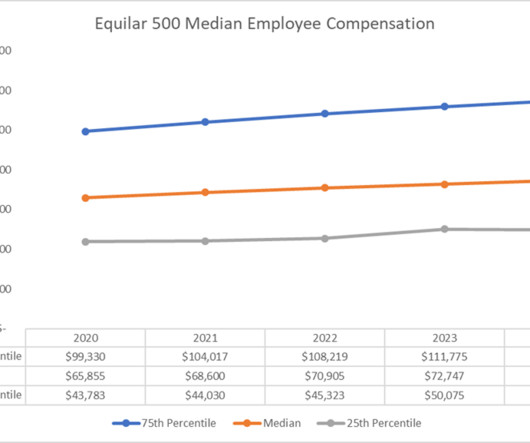

Posted by Joyce Chen, Equilar, Inc., on Tuesday, June 17, 2025 Editor's Note: Joyce Chen is an Associate Editor at Equilar, Inc. This post was prepared for the Forum by Ms. Chen. The 2025 proxy season has officially concluded, and companies have finished submitting their proxy statements (DEF 14A) to the Securities and Exchange Commission (SEC). These filings provide comprehensive insights into executive compensation practices and corporate governance structures.

Let's personalize your content