What a Difference a Year Can Make

Class VI Partner

NOVEMBER 14, 2022

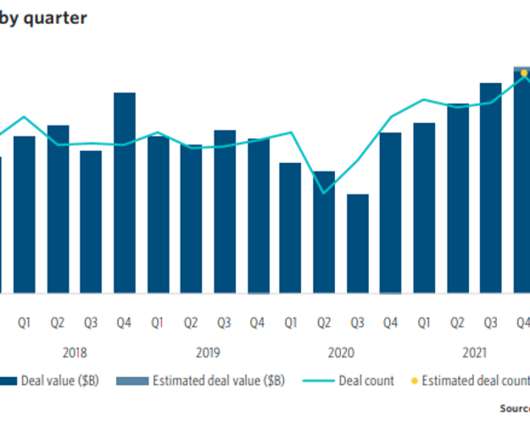

As a result, debt has become much more expensive for M&A market buyers relying on financing to execute deals. Average EBITDA multiples have consequently dropped in comparison to last year’s frenzied M&A period. As a result, they are relying heavily on buy-side quality of earnings reports and ramping up financial diligence.

Let's personalize your content