ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

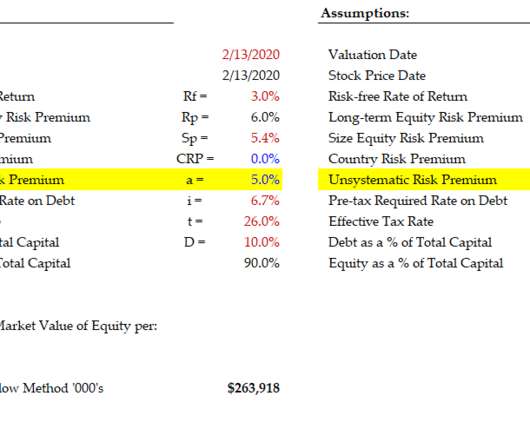

They combine elements of the Income Method, which is cash flow based, and the Market Method, which is based on comparative analysis. These approaches can be distilled into one central concept: adjusting the discount rate. Obviously the lower the discount rate, the higher the valuation, all other items held constant.

Let's personalize your content