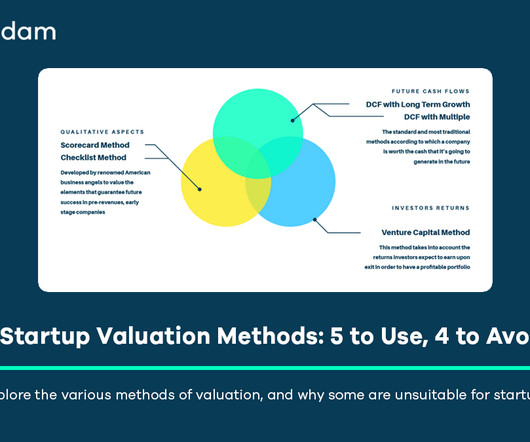

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Information asymmetry is also common; founders possess deep insights into their operations and vision, while investors must assess the opportunity based on limited data and their own market expertise. revenue multiple, ARR multiple, EBITDA multiple) derived from recent acquisitions or funding rounds of supposedly similar companies.

Let's personalize your content