EV/EBITDA Explained: A Key Valuation Multiple for Investors

Valutico

MAY 19, 2025

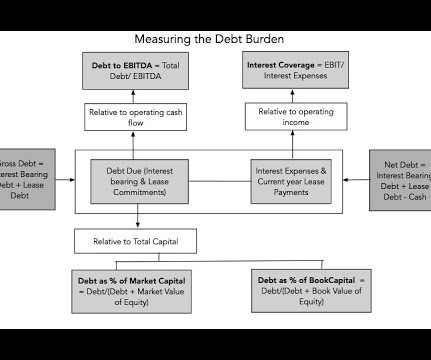

Company valuation employs different methodologies, including intrinsic approaches like Discounted Cash Flow (DCF) analysis, and relative valuation. To determine EBITDA, you can start with a company’s net profit or its operating profit (EBIT). EV/EBITDA is a widely used multiple in this relative valuation approach.

Let's personalize your content