The (Uncertain) Payoff from Alternative Investments: Many a slip between the cup and the lip?

Musings on Markets

JUNE 17, 2025

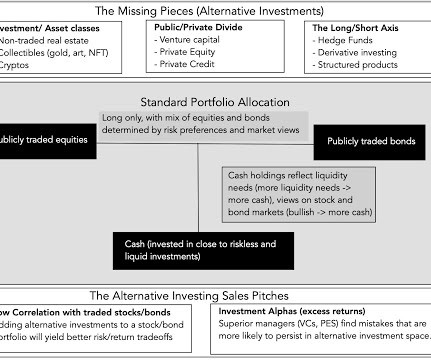

That argument has both a statistical basis, with the covariance between the two investments operating as the mechanism for the risk reduction, and an economic basis that the idiosyncratic movements in each investment can offset to create a less risky combination.

Let's personalize your content