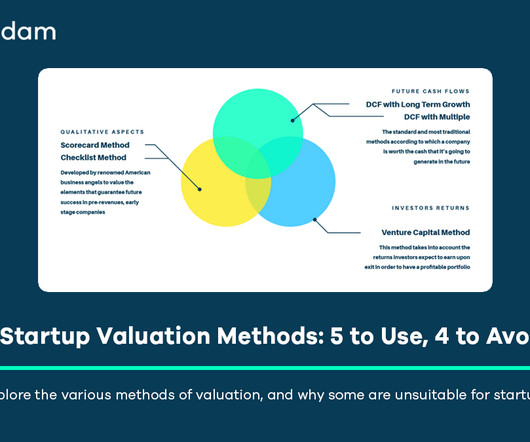

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Critiquing Unsuitable Methods for High-Growth Startups Several traditional or overly simplistic methods fail to adequately capture the unique characteristics of technology startups. butcher, barber) where assets are tangible and customer acquisition straightforward, it breaks down for technology startups.

Let's personalize your content