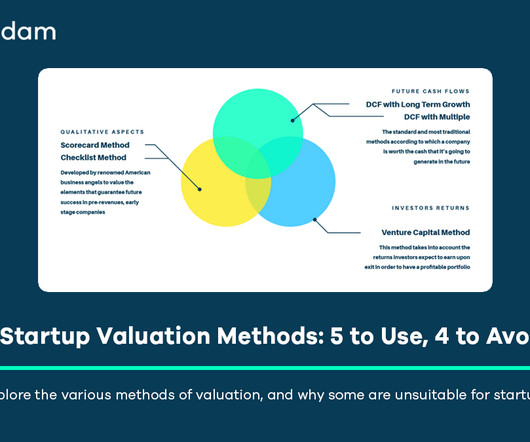

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Comparable Transactions (as a Primary Method): This method, often referred to as “comps,” involves applying valuation multiples (e.g., Discount Rate (Cost of Equity): The rate used to discount future cash flows reflects the riskiness of the investment.

Let's personalize your content