ESG Valuation Considerations – Top Down or Bottom Up?

Value Scope

JULY 21, 2020

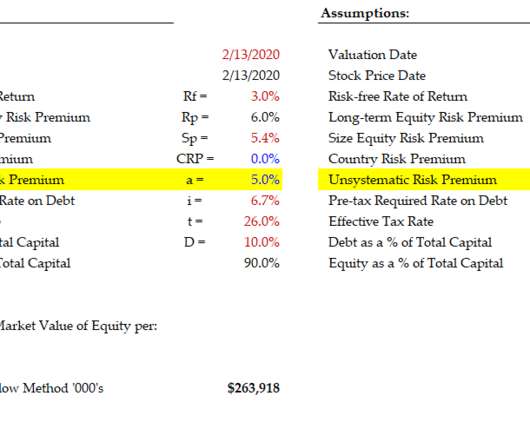

There are also methods to use Beta to assess a private company, if the Guideline Public Companies selected for the analysis, the “comps,” are chose properly. For example, in a recent valuation we completed, the mean unlevered Beta of a group of 10 comps was 0.58. The re-levered Beta for the private company we were valuing was 0.56.

Let's personalize your content