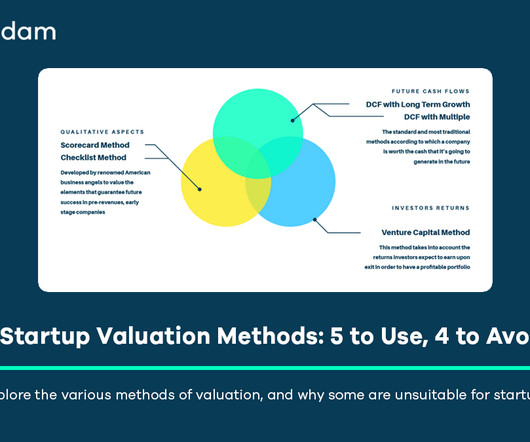

9 Startup Valuation Methods: 5 to Use, 4 to Avoid

Equidam

APRIL 26, 2025

Valuation as a Process, Not Just a Number A common misconception is that startup valuation aims to pinpoint a single, definitive “right” number representing the company’s price. Comparable Transactions (as a Primary Method): This method, often referred to as “comps,” involves applying valuation multiples (e.g.,

Let's personalize your content