Guide to accountant responsibilities

ThomsonReuters

JANUARY 18, 2024

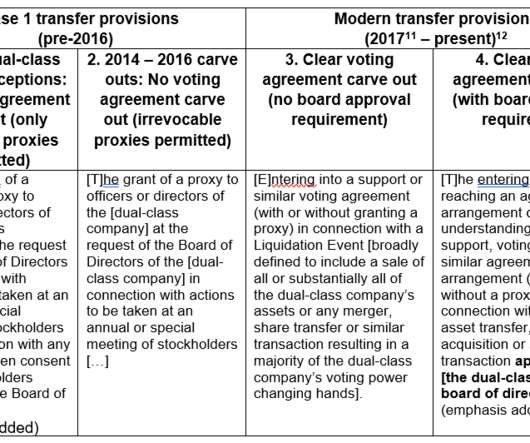

Jump to: What are the roles and responsibilities for accountants? Accountant vs. CPA vs. tax preparer: What are the differences? GAAP and AICPA What issues should accountants be aware of in the profession? What are the roles and responsibilities for accountants? How can accountants be more efficient?

Let's personalize your content